expanded child tax credit build back better

The original Build Back Better Act would have included a one-year extension of the expanded child tax credit which was nationally popular but greeted with skepticism from Manchin. Build Back Better would increase the child tax credit from 2000 to 3000 for children ages six and older.

The Build Back Better Framework The White House

Its a sign that Mr Manchin the.

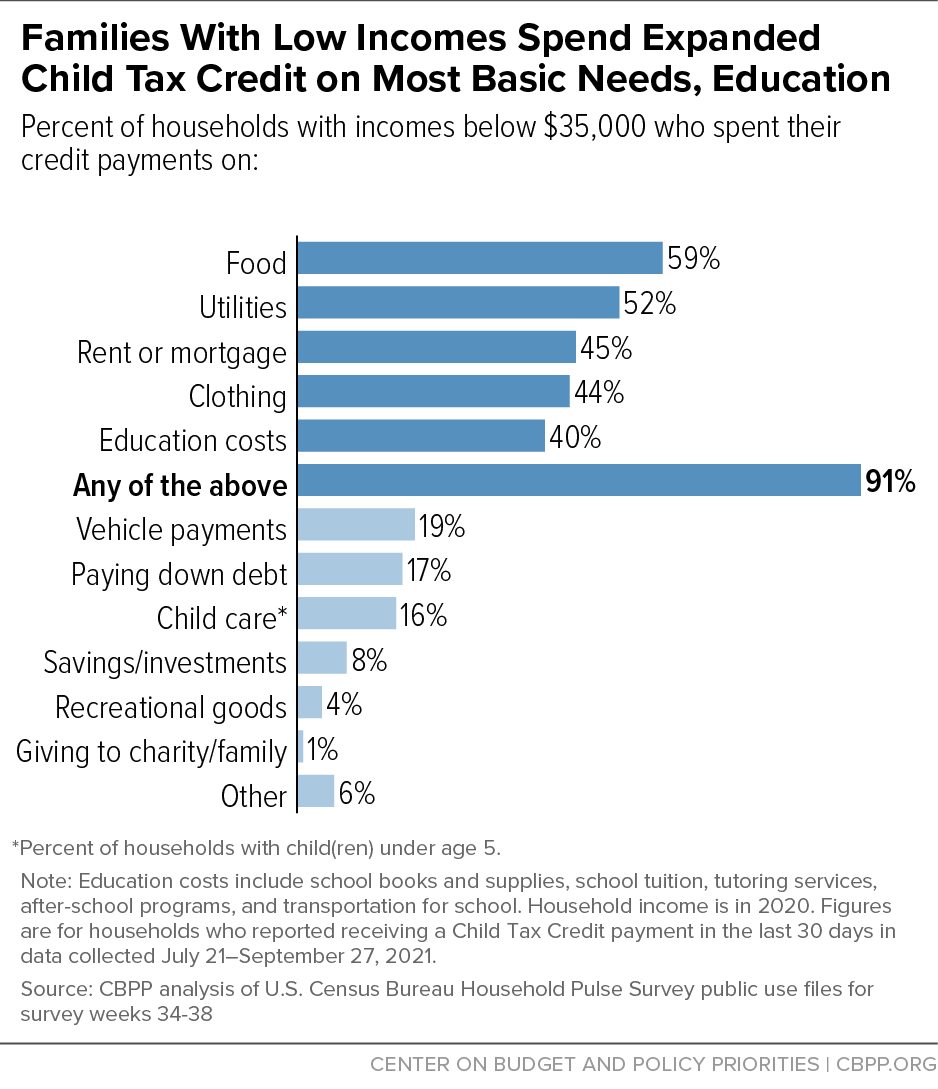

. The American Rescue Plan included a 300 a month child tax credit which ended up lowering the child poverty rate in America by over 40 percent Sanders added noting his amendment would restore the expanded for four years and be fully paid for by restoring the top corporate tax rate from 21 percent to 28 percent. Senate Majority Leader Chuck Schumer D-NY continued negotiating with Manchin on the parts of Build Back Better. A child tax credit CTC is a tax credit for parents with dependent children given by various countries.

President Bidens Build Back Better agenda calls for extending this tax relief for years and years. Separately the measure would continue the expanded earned income tax credit for 17 million low-wage workers. The current expanded CTC is a refundable credit being partially paid in.

Parents of eligible children must have an adjusted gross income AGI of less than 200000 for single filers and 400000 for. Expanded Medicare services and Medicaid. The Build Back Better bill would also make the refundability of the tax credit permanent.

Taxpayer income requirements to claim the 2022 Child Tax Credit. Hearing and dental coverage coverage for Medicare. And home care for elderly people and people with disabilities.

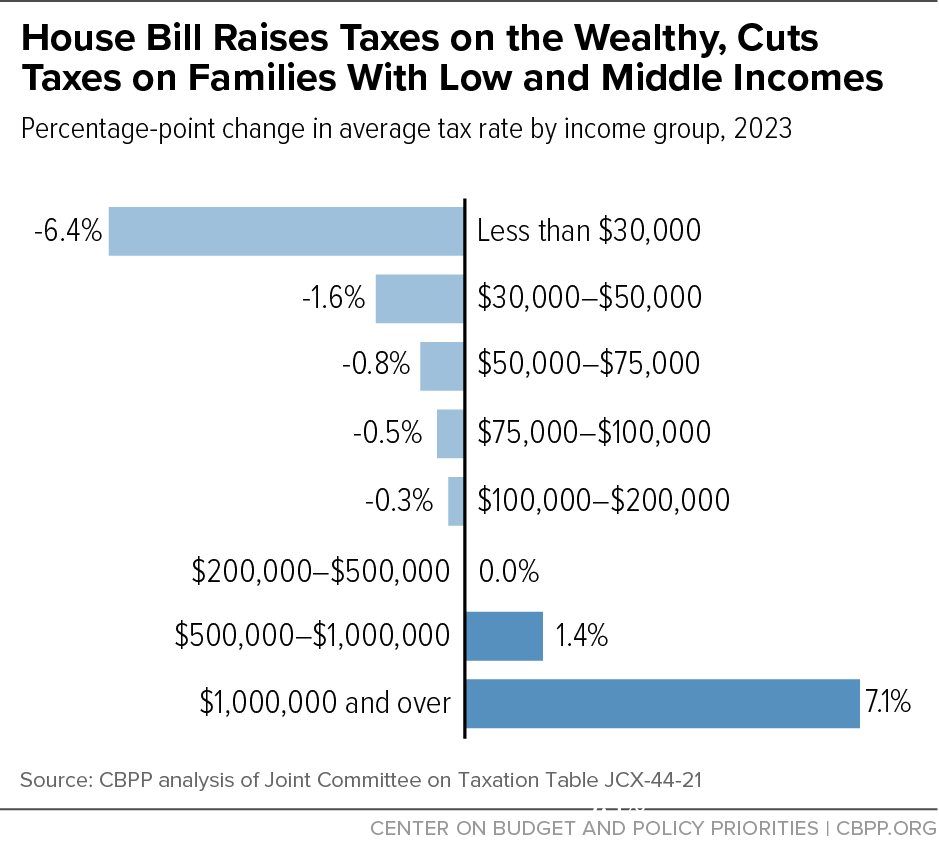

The bill grants a one-year extension of the pandemic-era child tax credit which provides parents with 300 every month per child under age six. With this in mind whether youre filing jointly with your spouse or separately the Child Tax Credit Portal is the place to reduce overpayments to prove eligibility for the expanded credit and to update your marital status or bank account information. The House Build Back Better plan would result in an estimated net revenue increase of about 1 trillion 125000 fewer jobs and on average less after-tax incomes for the top 80 percent of taxpayers by 2031.

The top 1 percent of earners would experience a 08 percent increase. The expanded child tax credit Democrats created in 2021 paid parents as much as 300 per child each month. Which is largely driven by the expanded child tax credit CTC.

The legislation is significantly pared down from Democrats proposed Build Back Better spending package which would have included everything from child care. The new tax credit for children under the. Children and teachers complete a mural in celebration of the launch of the expanded Child Tax Credit on July 14 2021 in Washington DC.

The Build Back Better plan could extend it for at least 2022. And refused to go along with a bill continuing the benefit as part of the Build Back Better agenda after 2021. 2021 expanded the Child Tax Credit for 2021 to get more help to more families.

The waiting period matters because for a family with three young children the fully refundable 10800 child tax credit payment would exceed the entire average family income in several Central. Expanded Child Tax Credit. The credit is often linked to the number of dependent children a taxpayer has and sometimes the taxpayers income level.

Build Back Better Verges on Collapse as Manchin Attempts to Kill Child Tax Credit. For example in the United States only families making less than 400000 per year may claim the full CTCSimilarly in the United Kingdom the tax. The Build Back Better Act will create millions of good-paying jobs enable more Americans to join and remain in the labor force spur long-term growth.

The American Rescue Plan included a 300 a month child tax credit which ended up lowering the child poverty rate in America by over 40 percent Sanders added noting his amendment would restore the expanded for four years and be fully paid for by restoring the top corporate tax rate from 21 percent to 28 percent. The Build Back Better Plan BBB was a 17 trillion package that proposed to fund an array of social investments from lower education and healthcare costs to extending the expanded child tax credit. Under Bidens Build Back Better spending plan working its way through Congress the currently expanded Child Tax Credit has provisions for a further one year extension and advance payments in 2022 bringing the total amount paid over 2 years to a maximum of 7200.

Jemal CountessGetty Images for Community Change. An expanded child tax credit.

The Build Back Better Framework The White House

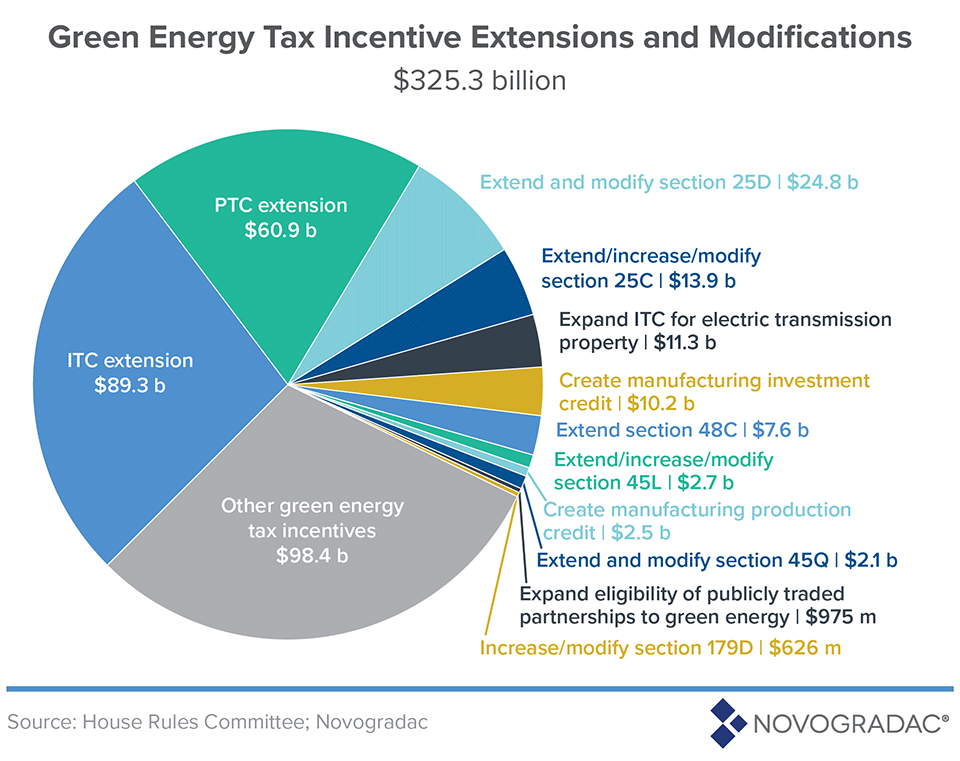

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

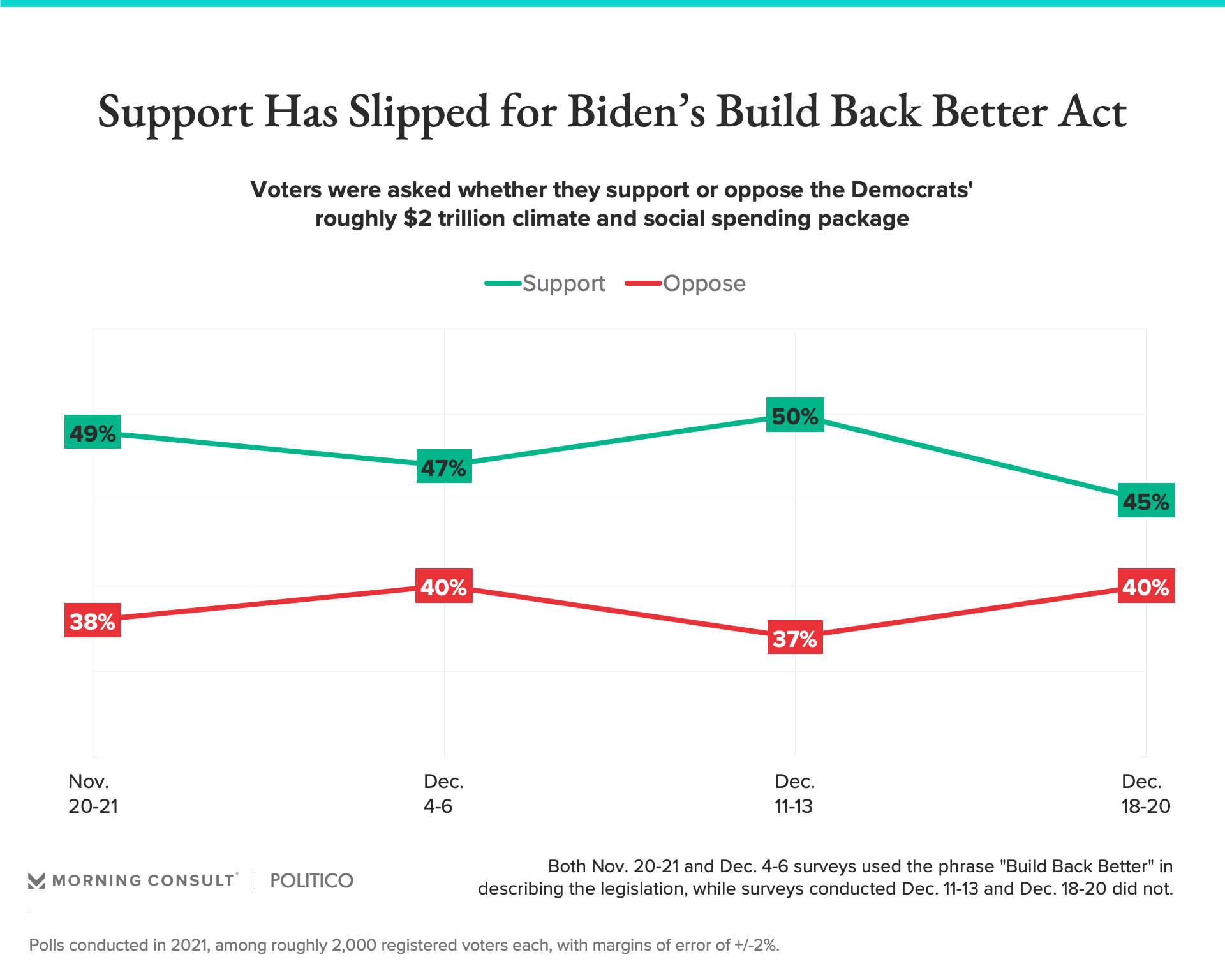

Why Biden S Expanded Child Tax Credit Isn T More Popular The New York Times

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

Policymakers Should Craft Compromise Build Back Better Package Center On Budget And Policy Priorities

House Passed 1 7 Trillion Build Back Better Reconciliation Legislation Includes 325 Billion In Green Energy Tax Incentives And More Than 92 Billion In Spending To Address Robust Climate Change Goals Novogradac

The Build Back Better Framework The White House

House Build Back Better Legislation Advances Racial Equity Center On Budget And Policy Priorities

What The Stalled Build Back Better Bill Means For Climate In One Chart The New York Times

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities

What S Actually In Biden S Build Back Better Bill And How Would It Affect You Us News The Guardian

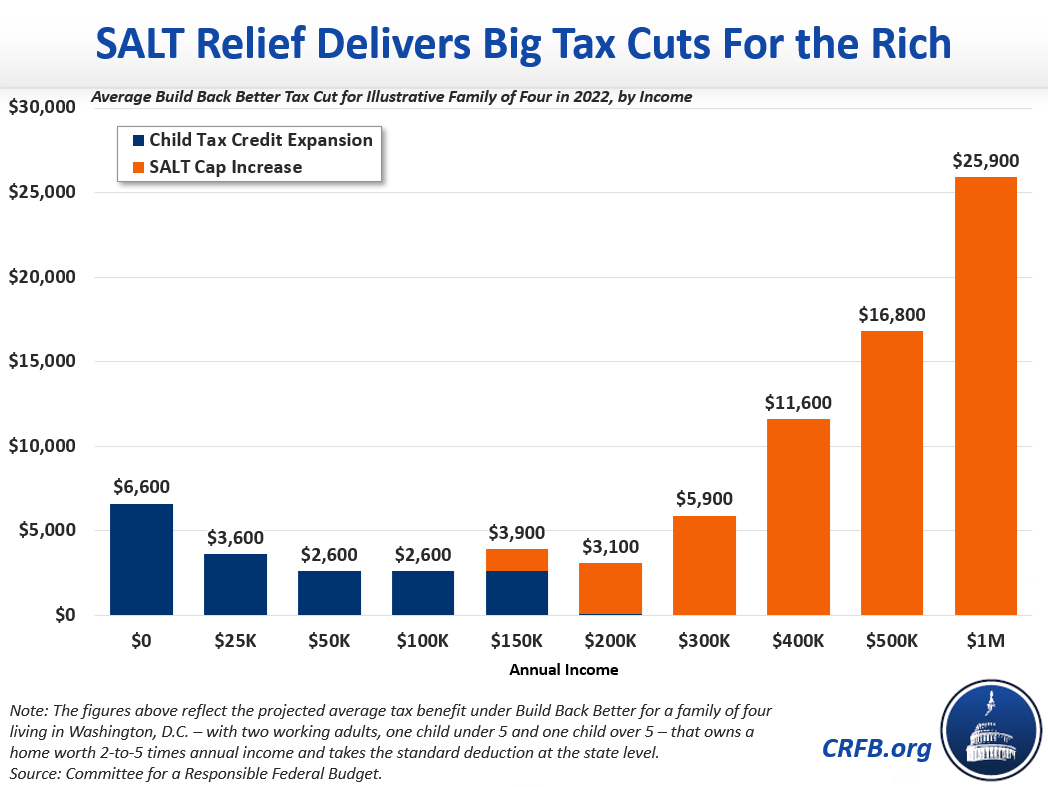

Build Back Better Salt Gains For The Rich Eclipse Child Credit Boost Committee For A Responsible Federal Budget

The Build Back Better Framework The White House

Parents Guide To The Child Tax Credit Nextadvisor With Time

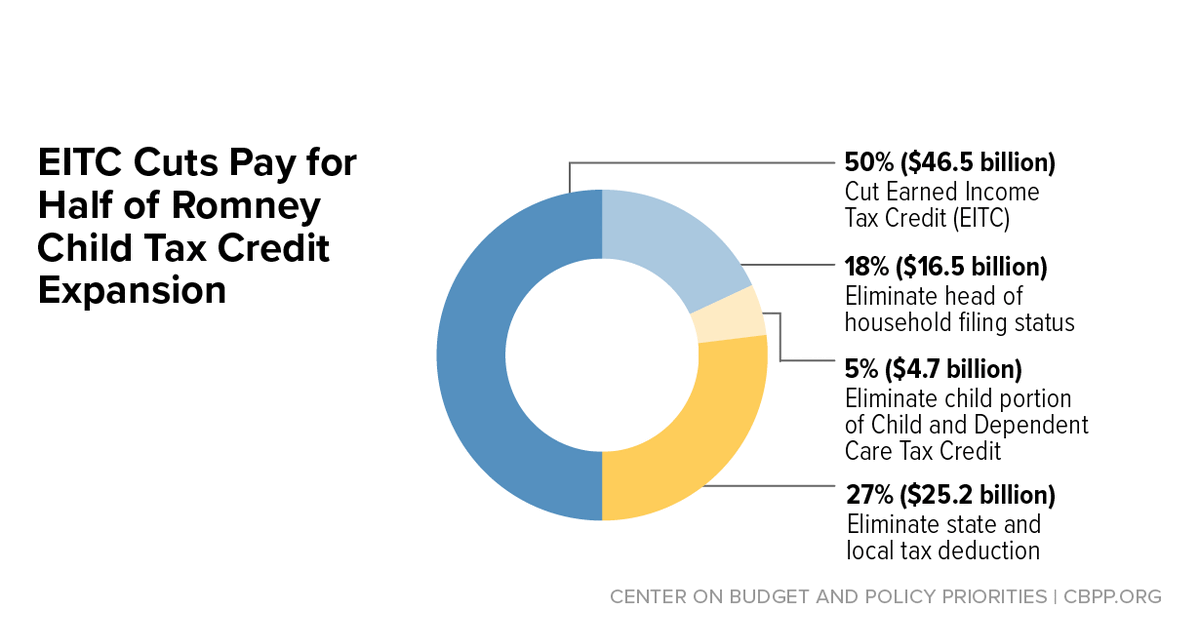

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Tax Credit Reforms In Build Back Better Would Benefit A Diverse Group Of Families Itep

Details Of House Democrats Cash Payments And Tax Credit Expansions Itep

Voters Are Divided Over One Year Extension Of Expanded Child Tax Credit